Seattle company partnering with OneApp Guarantee to keep 10,000 families from being denied rental approvals

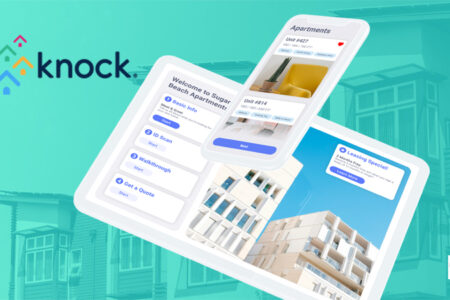

Knock® CRM, the leading performance management platform and CRM for multifamily property owners and managers, announced its Knocking Down Housing Barriers initiative to raise funds that will help renters access services to overturn denied applications due to low credit, income and eviction history. In partnership with OneApp Guarantee, which serves as the co-signer for these renters, Knock aims to raise $200,000 this year from employees, customers, partners and the multifamily industry to help 10,000 families gain access to housing.

In 2021, the average cost of rent in the U.S. increased by an unprecedented 17.8%, quickly outpacing inflation and wage increases. With continued low vacancy rates, most recently 4.3% in December 2021, the need for affordable rental housing is critical. Knock’s initiative is helping create an industry-powered housing access fund to address this demand.

The most common approval barriers for renters include income, credit, eviction history, debt-to-income ratio and lack of rental history: these measurements of risk are, unfortunately, inherently rooted in racism, according to OneApp Guarantee founder Tyrone Poole. While most property management companies allow the use of a co-signer to meet these requirements, for many renters, this is still unattainable– less than 2% apply with a co-signer.

Also Read: Top 5 Must Have Productivity Tools for Businesses

OneApp Guarantee acts as a co-signer on leases for people who may not otherwise qualify. The funds raised by Knock and other members of the multifamily industry will allow OneApp to offer a payment plan option for this program, allowing renters to make smaller, monthly payments until they cover the cost of the OneApp Guarantee fee. If the renter defaults on their payments, instead of putting their lease at risk, the community-raised funds will cover the difference.

“The multifamily industry has a duty to help solve these critical housing issues and help renters access the housing they need,” said Demetri Themelis, CEO of Knock. “While the vetting and screening processes still need to change to be more accessible to all, our hope is that the Knocking Down Housing Barriers initiative will help this reform by enabling more families to get approved for the housing they need.”

Knock began the Knocking Down Housing Barriers program internally in 2021, raising $26,000 to jumpstart the payment plan program that will help several hundred families gain access to housing, and decided to expand the initiative outside of the company for 2022 with the goal of helping even more renters.

“We receive over 1,000 denied renters per month looking to participate in our program,” said Poole. “Unfortunately, we are unable to overturn 80% of these denials because the applicants are unable to pay the full 1-time fee required to guarantee our housing providers upfront. Working with the Knocking Down Housing Barriers initiative, we’re able to launch a payment plan for these renters so they can pay the fee in installments.”

Also Read: Simulmedia Launches TV+, the Only Truly Cross-Channel TV Advertising Platform