Onfido’s Real Identity Platform Improves Performance by 12x with Fully Automated, End-to-End Identity Verification

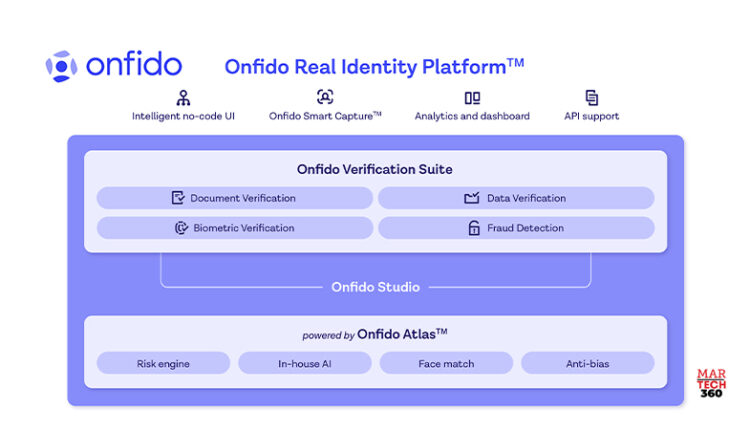

Onfido, the leading global digital identity verification and authentication provider, announced the expansion of its Real Identity Platform, improving fraud accuracy by 54% and fully automated performance by 12x. The platform simplifies identity for everyone. Now customers can reduce the complexity of sourcing and managing multiple identity verification vendors to meet local compliance regulations and can more easily mitigate fraud threats in an increasingly global marketplace. The Real Identity Platform includes four new products:

.@Onfido Real Identity Platform combines a suite of verification services, passive fraud detection signals & industry leading #AI; improves fraud accuracy by 54% and fully automated performance by 12x. https://bit.ly/3LIZOzZ #identityverification

- Onfido Verification Suite, a curated library of identity verification services including award-winning document and biometric solutions, trusted data sources, and innovative anti-fraud measures.

- Onfido Studio, a powerful identity orchestration layer that acts as the mission control for identity verification, enabling organizations to build and optimize multiple identity verification flows using the entire verification suite and no-code workflows.

- Onfido Smart Capture, a flexible, easy-to-integrate SDK that delivers over 90% first-time pass rates, with NFC verification, accessibility features, and intelligent end-user feedback to correct things like blurred or cropped images.

- Onfido Atlas™, the state-of-the-art AI decisioning engine that powers the entire platform, providing fully automated identity verification and authentication at global scale, with 95% of checks completed in less than 10 seconds. Its built-in anti-bias capabilities are unparalleled in the industry.

These additions to the platform enable organizations to optimize and automate the user experience while providing the highest levels of risk assurance.

Read More: 5 Required Skills And Role Of CTO (Chief Technology Officer) In An Organization

“Managing multiple vendors across end-user workflows is one of the biggest challenges banks can face in compliance and fraud prevention,” said Kavin Mistry, Head of Digital at TSB. “Onfido’s Real Identity Platform brings all this together, reducing that complexity and providing a valuable array of verification signals that will help make managing our customers’ identity much simpler.”

The Onfido Real Identity Platform allows organizations to build multiple workflows optimized for different market conditions, geographies, and risk tolerance that achieve the lowest fraud and highest end-user conversion rates, without the need to invest in additional customer support.

“Making identity proofing, fraud detection and user authentication capabilities work together across the user journey can improve risk mitigation, reduce costs and boost innovation in product or service offerings, but remains challenging for organizations to execute on,” said Akif Khan, Senior Director Analyst at Gartner.

“With the addition of multi-dimensional identity verification signals, organizations can now get a more holistic view of their customers and make faster, more informed decisions about which products or services to offer and when to offer them,” said Alex Valle, Chief Product Officer of Onfido. “By combining this with the flexibility of easily integrating identity verification at any point in the customer journey through drag-and-drop workflows, organizations can create the perfect user experience without compromising on fraud protection, all through a single API and best-in-class SDK.”

Comments are closed.