How Walled Gardens Triopoly is Boosting Revenue Generation in AdTech Industry

Walled Gardens in AdTech

Walled gardens are closed platforms or ecosystem in which the platform provider has complete control over the content, applications, media, and/or hardware and restricts access as it sees fit with the end goal of creating a monopoly.

As the triopoly of Google, Facebook, and Amazon has grown over the last decade, so has the height of these metaphorical walled gardens. Google, Facebook, Amazon, and others make billions of dollars from their in-house walled ad gardens. These high-margin platforms all have some things in common: they were built in-house from the ground up, they use first-party data, they have self-serve dashboards, and so on.

According to Statista, global digital advertising spending will reach 521.02 billion US dollars in 2021. According to the same source, spending would reach $876 billion by 2026. Marketers continue to spend more on these closed-ecosystem “walled garden” platforms, whose prices continue to rise. At the same time, brands receive less exposure on these platforms when compared to advertising displayed outside of walled gardens.

With Google’s announcement that it will phase out third-party cookies by 2022, it’s clear that the walls that keep so much data inside are about to get even higher. Advertising spend on the internet is increasing overall. As marketers spend more money on these platforms, they learn less about their customers because walled garden campaigns and interactions can’t be linked back to the brand’s CRM database. Rather than an individualized view that provides clarity into the campaign’s performance, brands typically receive an aggregate view of how their campaign performed.

With Google’s announcement that it will phase out third-party cookies by 2022, it’s clear that the walls that keep so much data inside are about to get even higher. Advertising spend on the internet is increasing overall. As marketers spend more money on these platforms, they learn less about their customers because walled garden campaigns and interactions can’t be linked back to the brand’s CRM database. Rather than an individualized view that provides clarity into the campaign’s performance, brands typically receive an aggregate view of how their campaign performed.

Walled Gardens of Ad-tech

Some of the world’s largest technology and publishing companies take advantage of this strategy by creating their own walled gardens, making themselves the only option for users in many cases. While walled gardens may appear to be menacing and controlling, they can also be extremely beneficial to publishers. After all, you can go to one place and potentially meet all of your publishing needs. Walled gardens provide publishers with massive audience reach, monetization options, and opportunities to increase referral traffic.

Facebook ( Meta )

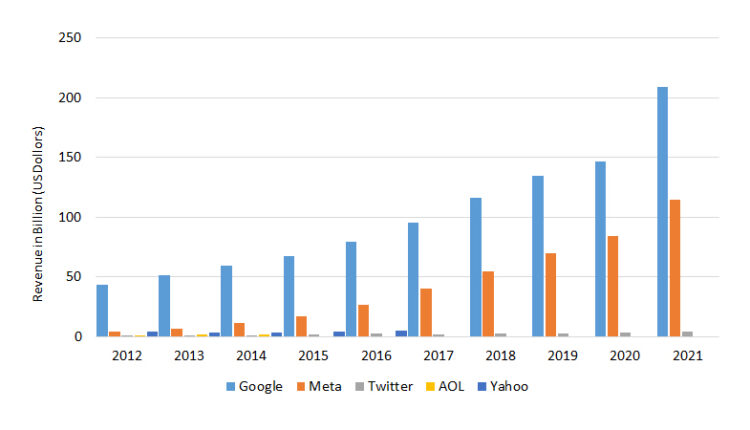

In 2021, Meta (Facebook) earned $114.93 billion in ad revenue, while Google earned nearly twice as much ($209.5 billion). Facebook has the most reach potential for advertisers and publishers, with over 2.9 billion monthly active users as of January 2022. It also has access to deterministic data. Users log in to their Facebook accounts on multiple devices, resulting in the most precise advertising targeting.

Facebook has massive amounts of user data. This enables them to provide one of the most comprehensive targeting solutions currently available in the advertising industry. Using the criteria we discussed previously, we can see that Facebook checks all three boxes. They require advertisers to use their DMP, DSP, and DCO, and they keep a significant portion of campaign performance data in-house.

Google AdSense, one of the world’s largest display ad networks, is powered by the demand of over 2 million advertisers from Google Ads. Google Ad Manager (GAM), the world’s largest ad management platform, combines an ad server and ad exchange (Google AdX) owned by Google. More than 80% of Google’s revenue comes from advertising, putting Google in nearly complete control of the advertising industry.

Google AdSense, one of the world’s largest display ad networks, is powered by the demand of over 2 million advertisers from Google Ads. Google Ad Manager (GAM), the world’s largest ad management platform, combines an ad server and ad exchange (Google AdX) owned by Google. More than 80% of Google’s revenue comes from advertising, putting Google in nearly complete control of the advertising industry.

Amazon

![]() While most people associate Amazon with its massive eCommerce platform, many are unaware that the company has reported generating over $20 billion in ad revenue through its Amazon Ads service. Aside from having the same distinct walled garden characteristics as Google and Facebook, they have something those companies don’t, at least not in the same capacity. Amazon also has purchase data from the 18.5 purchases made on their platform every second.

While most people associate Amazon with its massive eCommerce platform, many are unaware that the company has reported generating over $20 billion in ad revenue through its Amazon Ads service. Aside from having the same distinct walled garden characteristics as Google and Facebook, they have something those companies don’t, at least not in the same capacity. Amazon also has purchase data from the 18.5 purchases made on their platform every second.

One important reason for this expansion is that Amazon has something that Google and Facebook do not: purchase intent data. While Google and Facebook know what users search for and click on, Amazon knows what users buy, from whom, and how frequently, which is extremely valuable to certain buyers, such as e-commerce brands and retailers.

Read More: 5 Ways Digital Publishing Aids Revenue Generation In B2B Businesses

Building The Triopoly of Walled Gardens

Understanding walled gardens entails discussing the industry’s biggest players: Google, Amazon, and Facebook. These are the three ad tech behemoths that control more than half of all digital ad spend. While Google collaborates with other companies, Facebook and Amazon prefer to keep their data-sharing barriers as high as possible. So, how did everything come together?

They built their own advertising platforms from the ground up. This gave them the freedom to create what they wanted, on their terms, such as native ads that don’t interfere with the user experience, such as promoted posts, sponsored listings, and so on, as well as targeting options that are unique to their product.

They built their own advertising platforms from the ground up. This gave them the freedom to create what they wanted, on their terms, such as native ads that don’t interfere with the user experience, such as promoted posts, sponsored listings, and so on, as well as targeting options that are unique to their product.

- Then, using their proprietary first-party data, they delivered impressive results for direct-response advertisers while also providing valuable targeting options for branding advertisers.

- Following that, these companies scaled with self-serve dashboards to reach long-tail advertisers who manage their own ads and can set up campaigns targeting their ideal audience.

- Finally, these companies are one-of-a-kind in terms of size and resources: Google, Facebook, and Amazon are three of the world’s most visited platforms, and more traffic means more ad revenue.

Technology of the Walled Gardens

When you can force your clients to use your entire marketing stack to run their campaigns, you have reached the “Walled Garden” level in the Digital Marketing field. There are three primary technologies for constructing a walled garden:

Data Management Platform (DMP)

A data management platform (DMP) is a centralized platform for collecting, organizing, and activating first-, second-, and third-party audience data from any source, including online, offline, mobile, and other sources. It serves as the foundation of data-driven marketing, allowing businesses to gain unique insights into their customers.

A DMP collects and organizes data from various first-, second-, and third-party data sources and makes it available to other platforms such as DSPs, SSPs, and ad exchanges for use in targeted advertising, personalization, content customization, and other applications. A data management platform is sometimes referred to as the “pipes” of ad tech, as it connects many platforms in a neutral manner, allowing marketers to use their powerful audience data whenever and wherever they want.

Demand-Side Platform (DSP)

A demand-side platform (DSP) is a programmatic advertising platform that allows advertisers and media buying agencies to automatically bid on display, video, mobile, and search ad inventory from a variety of publishers. In real-time, a demand-side platform can automate the decision-making process for how much to bid for an ad. DSPs make the ad-buying process much faster, less expensive, and more efficient.

The key feature of demand-side platforms is that instead of purchasing inventory from publishers, you purchase the ability to reach specific audience segments across a variety of publisher sites using the DSP targeting capabilities. Demand-side platforms are an evolution of ad networks, which have included capabilities such as real-time bidding in their offerings.

Dynamic Creative Optimization (DCO)

Dynamic creative is simply the incorporation of graphics within an ad’s creative while utilizing the customer’s specific data such as geolocation, products seen, and so on to improve the overall appeal and possibly even functionality of the ads. When creating such ads, the graphic components are pre-defined during campaign setup, while dynamic real-time information is added for each user simultaneously before the ad is served.

When it comes to dynamic creative optimization, however, the technique goes beyond simply filling in personalized data with generic creatives. It employs machine learning and artificial intelligence techniques to select the most relevant components for each shopper in real time.

Advantages and Disadvantages of Walled Gardens

Walled gardens can become monopolies, suffocating competition and creating unbalanced power dynamics, but they can also be extremely effective tools for advertisers, publishers, and even users.

Advantages

-

Accuracy for Advertisers:

Advertisers can use rich user data from walled gardens like Facebook, The New York Times, and Google to create targeted campaigns that not only produce a profitable ROI for the advertiser but also potentially give the user more of what they actually want.

-

User Security:

Apple, for example, takes pride in the walls of their walled gardens. User data is encrypted so that no sensitive information is shared, and user consent is even required to make certain tracking options available to advertisers. Within a closed platform, the service provider is in charge of the data and can design effective data-protection systems.

-

Targeting Across Devices:

The majority of users do not restrict their Google searches, article browsing on publisher websites, or Amazon purchases to a single device. Instead, the majority of users access these platforms via laptops, smartphones, and tablets. This provides these platforms with cross-device data that can then be shared with advertisers, as well as access to the users’ lives regardless of which device they are using.

Disadvantages

-

Difficult to Create and Maintain:

In the case of a platform like The New York Times, obtaining an audience in the first place was extremely difficult, as there was a lot of competition to contend with and years of effort required. Maintaining a platform like that, as well as managing thousands of employees and millions of users, is no easy task.

-

Competitive Landscape:

Establishing a closed platform on the internet can be extremely rewarding, and as we’ve seen over the years, there’s no shortage of businesses vying for the top spot in social media, eCommerce, or search. To be the market leader, you must constantly innovate.

-

Difficult to Scale:

Websites can be both simple and difficult to scale at the same time. After all, a website that attracts users must have high-quality content and be constantly improving. Otherwise, another website will undoubtedly overtake you.

Impact on Publishers

Strong demand-side competition directly benefits publishers by generating a higher yield for every available impression. In fact, this is why header bidding became popular, which also serves as an example of how walled gardens affect publishers.

The ecosystem in which publishers sell their ad inventory is controlled by walled gardens, and publishers have no choice but to accept the rules of the game. As a result, publishers with large audiences are creating their own walled gardens.

Large publishers with large first-party datasets end up creating their own walled gardens, providing ad-supported content to some users while charging subscription fees to others. To combat walled gardens and reach advertisers directly with robust audience data, small and mid-sized publishers are forming login alliances and collaboratives.

The best antidote to walled gardens for publishers is a better understanding of their own audience. Include demand-agnostic ad tech partners in their monetization strategy and figure out how to package their inventory in ways that are appealing to advertisers.

Inferring on this

In the end, competing with or usurping mature walled garden tech platform with scale like Google, Amazon, and Facebook is virtually impossible, but these ecosystems can have a significant impact on the lives of publishers, advertisers, marketers, and the world in general. Publishers can try to build their own walled gardens, but in the world of advertising, the path of least resistance is to go where the people are already, and there are billions of people in the walled gardens.

Read More: How Customer Data Platform (CDP) Is Driving Business Growth In 2022

Read More: How Customer Data Platform (CDP) Is Driving Business Growth In 2022

Comments are closed.