Customer Satisfaction with Municipal Energy Utilities Improves Despite Massive Tumble by CPS Energy, ACSI Data Show

Residential customer satisfaction with the energy utilities sector overall creeps up 0.3% to 72.2 (on a scale of 0 to 100), according to the American Customer Satisfaction Index Energy Utilities Study 2021-2022.

“The progress of the smaller group of municipal energy utilities has the greatest impact on the industry itself, but CPS Energy’s 14% recession year over year is hard to ignore. Clearly, the utility’s satisfaction shows long-lasting damage stemming from last year’s devastating winter storm in Texas and its aftermath.”

Of the three categories measured in the report, cooperative energy utilities, unchanged at 73, now share the top spot with municipal energy utilities, up 2.8% year over year. Investor-owned energy utilities are just behind the leaders, with a steady ACSI score of 72.

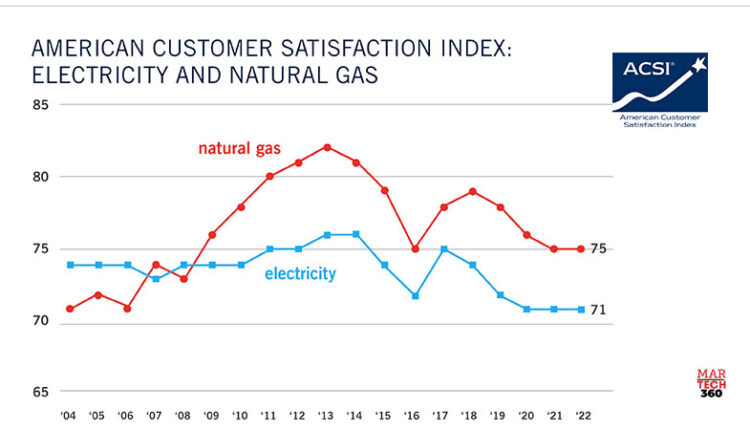

Following three straight years of decline, natural gas service is stable at 75. It still outpaces electricity, which is unchanged at 71.

“While overall customer satisfaction remains relatively stable in the energy utilities sector, there is movement in the municipal category that raises some eyebrows,” says David VanAmburg, Managing Director at the ACSI. “The progress of the smaller group of municipal energy utilities has the greatest impact on the industry itself, but CPS Energy’s 14% recession year over year is hard to ignore. Clearly, the utility’s satisfaction shows long-lasting damage stemming from last year’s devastating winter storm in Texas and its aftermath.”

Also Read: How Is Influencer Marketing Responsible For Changing Consumer Behavior In 2022?

CenterPoint Energy separates itself among investor-owned energy utilities

Customer satisfaction with investor-owned energy utilities is unchanged at an ACSI score of 72.

CenterPoint Energy takes sole possession of first place after improving 3% to 78. A stable Atmos Energy is next at 76, followed by NextEra Energy (down 1%), Southern Company (unchanged), and WEC Energy Group (up 3%), all at 75. Dominion Energy inches up 1% to 74.

Four utilities sit just above the industry average with ACSI scores of 73: Berkshire Hathaway Energy (unchanged), Consolidated Edison (unchanged), NiSource (down 3%), and Sempra (up 1%).

The group of smaller investor-owned utilities bounces back 3% to the industry average of 72, tying with six other providers: Ameren (down 1%), CMS Energy (up 1%), Duke Energy (up 1%), Exelon (unchanged), PPL (down 3%), and Xcel Energy (unchanged).

Public Service Enterprise Group stumbles 3% to 71, just ahead of FirstEnergy, which slips 3% to 70. Five utilities tie at 69, all experiencing downturns: American Electric Power (down 1%), DTE Energy (down 5%), Edison International (down 4%), Entergy (down 4%), and National Grid (down 1%).

Despite being at the bottom of the industry, Eversource improves 2% to 66, and PG&E is stable at 61.

Salt River Project leads municipal energy utilities, while CPS Energy nosedives

Overall, customer satisfaction with municipal energy utilities increases 2.8% to an ACSI score of 73. After slipping last year, industry leader Salt River Project rises 1% to 76.

Smaller municipal energy utilities gain ground, climbing 3% to 73, while the Los Angeles Department of Water and Power holds steady at 68. CPS Energy falls to the bottom of the industry after plunging 14% to 63.

Smaller energy utilities move into cooperative category’s top spot

Cooperative energy utilities serving small rural communities maintain stable customer satisfaction overall with an ACSI score of 73.

The group of smaller cooperatives leads the industry after inching up 1% to 74. Following closely behind, Touchstone Energy is unchanged at 73.

Also Read: How Mobile Apps Can Drive Your Digital Marketing Strategy in 2022

Comments are closed.