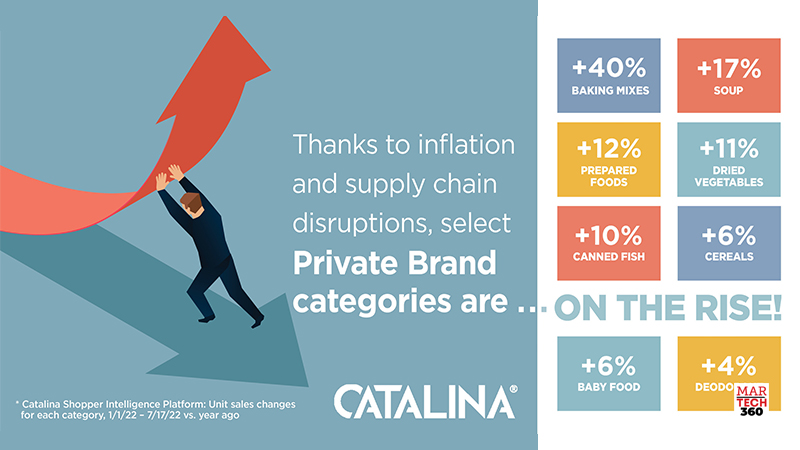

With rising inflation and ongoing supply chain issues continuing to unsettle consumers, shopper intelligence leader Catalina is closely tracking the sales impact on grocery retailers’ private/store brands.

Private brand categories showing the biggest gains year to date through July 17, 2022, per Catalina’s Shopper Intelligence Platform, include Baking Mixes (up 40%), Soup (up 17%), Prepared Foods (up 12%), Dried Vegetables (up 11%), Canned Fish (up 10%), Cereal and Baby Food (both up 6%) and Deodorant (up 4%).

Also Read: BoomBox Director Explains Importance Of Memorable Brand Mnemonic

Among the insights Catalina gleaned from its recent private brand analysis:

- The rise in unit sales of store brand staples like canned fish and soup indicates consumers are looking for affordable lunch and dinner solutions.

- With the USDA reporting brand name cereal prices rising between 10-11% in 2022, private brand alternatives are benefiting.

- While the pandemic-fueled trend of scratch baking has declined, baking mixes remain popular, with shoppers increasingly opting for store brand mixes (up 40%).

- As more consumers return to the office, purchases of affordable personal grooming items like deodorant as well as prepared foods are also on the rise.

- Shoppers also are scooping up private brand baby food and formula, looking for alternatives amidst a nationwide shortage of brand name products in this category.

“The data clearly indicates that shoppers have become more price-sensitive and value-driven in recent months,” said Sean Murphy, Chief Data & Analytics Officer. “Our platform powers these sorts of insights, helping us advise our retailer and CPG customers on the most effective shopper audiences, marketing messages and offers to measurably impact sales.”

As outlined in Catalina’s recently published Inflation Guide, private brand marketers can use ultra-precise personalization and real-time responsiveness to deliver value to shoppers. Catalina’s responsive marketing portfolio of solutions includes: sequential marketing, which uses a sequence of ads to tell a brand story over time with planned touchpoints to ultimately drive conversion; retargeting, which enables marketers to segment audiences, hone messaging, and bring consumers back into the brand conversation; and audience suppression, which keeps specific people or groups from receiving an ad if they have already purchased a brand – or a competitor’s brand – reducing redundancy and ensuring media efficiency.

Catalina is a leader in shopper intelligence and highly targeted in-store, TV, radio, podcast and digital media that personalizes the shopper journey. Powered by the world’s richest real-time shopper database, Catalina helps retailers, CPG brands and agencies optimize every stage of media planning, execution and measurement to deliver $6.1 billion in consumer value annually. Catalina has no higher priority than ensuring the privacy and security of the data entrusted to the company and maintaining consumer trust. Catalina has operations in the United States, Costa Rica, Europe and Japan.

Comments are closed.